Didi, who was used to changing tires while driving, took the initiative to press the brakes this time.

At the beginning of 2019, Didi Chuxing suddenly turned the wind. First, it was exposed that the company’s annual loss in 2018 was as high as 10.90 billion yuan, and a total of 11.30 billion yuan was subsidized to drivers in 2018. Then, Didi announced the news of layoffs semi-actively.

At Didi’s monthly staff meeting on February 15, Didi CEO Cheng Wei announced that he would "shut down and transfer" the non-main business, and would lay off 15% of the overall workforce, involving about 2,000 people.

In the turbulent Internet market of the past two years, there are many founders who have called out to be ready for the winter like Cheng Wei, but most bosses prefer to use "optimization" instead of "layoffs". In this comparison, Cheng Wei, who took the initiative to call for a 15% layoff, has now become a complete exception.

As a start-up company that has emerged from the shadow of Internet Tech Giants, Didi, which is led by Cheng Wei, is now a "shadow" that many entrepreneurs in the mobile transportation field cannot escape.

However, the current Didi itself also has an indescribable "shadow".

Subsidized Rashomon

This widely circulated internal financial data of Didi Chuxing is a bit interesting.

In fact, only two figures were announced, one is that Didi continued to lose money in 2018, and it was a huge loss of 10.90 billion yuan. In addition, Didi invested 11.30 billion yuan to subsidize drivers throughout 2018.

It should be added that Didi had previously released unofficial data saying that Didi’s annual loss in 2017 was only 2.50 billion yuan. At that time, the market also believed that Didi was expected to turn losses into profits in 2018.

For this reason, the simplest and most crude conclusion that some people have drawn is that a large number of subsidies to drivers caused Didi to lose a lot last year. If it weren’t for the more than 10 billion yuan in driver subsidies, how could Didi have lost so much in 2018?

But this conclusion Didi drivers have expressed their dissatisfaction.

Many special car drivers still remember the good days from the end of 2014 to the Spring Festival in 2015: a smart phone, a driver’s license with a driving age of more than 3 years, and a local license plate car with a price of more than 100,000 RMB and a service life of less than 5 years. As long as you have these three basic "equipment", no matter which special car platform you connect to, many special car drivers can easily earn more than 10,000 yuan per month and envy others.

At that time, all the special car companies could easily pick out the special car drivers with a monthly income of 20,000 to 30,000. And subsidies are the direct driving force that makes many special car drivers full of motivation.

But such good times only stayed in 2016, before the merger of Didi and Uber China.

You know, back then, Uber China’s subsidies for private car drivers used to have an enviable "reward of 8,000 yuan for 80 orders a week". At that time, Uber drivers could earn 20,000 yuan a month only with rewards.

When Didi and Uber were at their worst in China, Cheng Wei said that Didi spent $4 billion a year on "market cultivation." Uber founder Travis Kalanick previously revealed that Uber lost more than $1 billion in the Chinese market in 2015, and also subsidized the profits in other global markets to the Chinese market.

But all these subsidies for drivers came to an abrupt end after Didi’s dominance. With the return of market competition to rationality, Didi’s subsidy policy for drivers has also shrunk more and more. As a last resort, some special car drivers have to calculate the water in the car carefully, and sometimes secretly replace Kunlun Mountain with Master Kang, or if passengers don’t want it, they won’t let it go.

And the current net about car compliance under the ebb and flow is to make a lot of net about car drivers unsustainable, because of insufficient qualifications or less money, many net about car drivers have changed careers.

Looking at it this way, it should be that the online car-hailing drivers are wronged. They obviously didn’t see much of the subsidies they received, and they were unwilling to bear the blame for Didi’s huge loss.

But if you add the cost of ride-hailing compliance to driver subsidies, the bill seems to make sense again.

The recent December 31, 2018, was once regarded as an important node in the online car-hailing market. In the 2018 online car-hailing rectification, relevant departments required all online car-hailing platforms to clear all unlicensed vehicles before December 31.

But this "one size fits all" rule may take some time to implement.

At present, most online car-hailing platforms have not completely stopped sending orders to unlicensed vehicles to respond positively.

Didi has publicly stated on December 18, 2018 that it will continue and speed up the removal of drivers and vehicles on the platform that do not meet the requirements of the Interim Measures for the Management of Online Booking Taxi Business Services, strengthen the guidance of dispatching orders for compliance, and gradually reduce the dispatch of non-compliant personnel and vehicles until it stops.

But Mr. Cheng also stressed that it would take time and that Didi would "develop phased city-by-city compliance targets", as required by the new policy.

The first financial reporter learned that Didi has indeed increased its investment in compliance, set up documents to promote special project funds, organized full-time personnel to speed up the application of documents, actively organized driver training, and partners to encourage and guide drivers to handle people’s car permits.

In order to guide the active compliance of online car-hailing drivers, Didi has increased the subsidy for compliance drivers to a certain extent.

As of now, online car-hailing drivers with three or more licenses can still take orders on the Didi platform. However, drivers generally report that the platform’s orders will be given priority to online car-hailing cars with three licenses, and the rewards received by different drivers will also vary.

This is also one of the important reasons why Didi’s losses intensified in the second half of 2018.

After the murder of the hitchhiker, in September 2018, Cheng Wei rarely announced Didi’s profits in an internal open letter, saying that the company’s overall net loss in the first half of 2018 exceeded 4 billion yuan.

This 4 billion yuan loss, because Meituan has to increase the cost of subsidies in the corresponding cities because Meituan has stepped into the taxi, and in order to face Meituan takeaway, Didi has invested in the takeaway business.

But if combined with the data of 2018 full-year loss 10.90 billion, in the second half of 2018 after Meituan stopped taxi investment and Didi takeaway stopped crazy subsidies, Didi’s loss exceeded 6 billion, significantly higher than the first half of the year.

On the other hand, Didi is also doing something more asset-heavy.

The reporter learned from people close to Didi that in order to ensure sufficient compliance capacity, Didi has increased its investment in self-operated vehicles in the past two years, in addition to purchasing cars, but also recruiting full-time drivers to operate.

Investing a large amount of money in self-operated vehicles is actually contrary to Didi’s previous asset-light model of integrating idle capacity.

"Shut down and transfer" non-main business

In addition to layoffs, Cheng Wei also emphasized at the above-mentioned monthly meeting that Didi will focus on the most important travel business in 2019, continue to increase safety and compliance investment, and improve efficiency. Therefore, it will "shut down and transfer" non-main businesses.

It has to be said that Didi’s business expansion speed in recent years has been too fast.

In mid-February 2015, when Didi announced its merger with Kuaidi, the two companies were only involved in taxis and special cars, but by September 2015, Didi had already owned taxis, special cars, express cars, hitchhiking, and driving on behalf of five mature product lines.

"Since this year [2015], we have launched a business every two months, and within a month of each business launch, we have become the absolute leading brand and the number one in the industry," Cheng Wei explained in an interview with China Business News.

Before the killing of Hitch, Didi maintained a record of six years of business valuation of 80 billion dollars. Throughout the development of China’s Internet, it seems that few Internet companies have such an amazing growth history as Didi.

In 2014, the sharing economy blew the wind and waves penetrated all walks of life, but the sharing industry needs to burn money and throw money. In this industry where the profit model is not yet clear, hundreds of companies become members of the death list every year. So much so that sometimes, Cheng Wei himself can’t help but sigh to Liu Qing, president of Didi Chuxing, "We are a company in a sea of swords and fire".

In the past six years, there have been 20 to 30 business units operating within Didi, with many successful experiences and many lessons learned from failures.

Half a month before the murder of a hitchhiker in Yueqing, Cheng Wei said at the Lenovo Star 10th Anniversary Conference about starting a business that entrepreneurs are the most difficult group of people, like pushing open a door, it is dark outside, and the road is not clear. It is necessary to constantly explore, understand, and correct.

Only this time, what Didi needs is a major correction.

On December 5, 2018, Didi announced an important corporate organizational restructuring.

In the above organizational restructuring, Didi’s core business and multiple departments will be merged and adjusted, including the merger of the express business group, the establishment of the online car platform company, the merger of the original Xiaoju car service and the automotive asset management center (AMC), the upgrade to new car service, and the establishment of a car owner service company.

"This structural adjustment is mainly for the safety of online car-hailing, to facilitate compliance management." A Didi insider told the First Financial Reporter that Cheng Wei has set a high profit target for the newly established online car-hailing platform company in 2019.

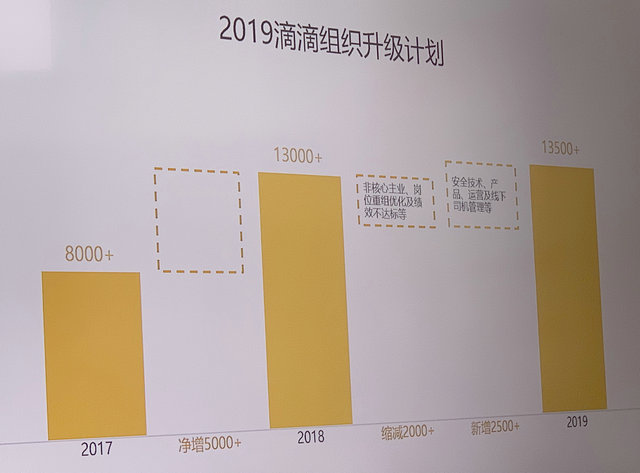

It is worth mentioning that while "shutdown and transfer" and layoffs, internationalization is still a key area of Didi. In key areas such as safety technology, products and offline driver management and internationalization, Didi will continue to recruit 2,500 people in 2019. The goal is that the total number of employees by the end of 2019 will be the same as 13,000 at the end of last year.

In 2017, Uber, which had been making great strides in globalization, had to reluctantly cut the meat. First, it decided to merge its mobility business with its Russian rival Yandex NV, ceding the ride-hailing business in six countries: Russia, Armenia, Azerbaijan, Belarus, Georgia, and Kazakhstan. Then it announced that it would suspend its ride-sharing business in Macau.

Compared with Uber, whose overseas territory has been shrinking, Didi has blossomed in overseas investment business one after another. A few days after announcing its pursuit of Grab, which is known as Didi in South East Asia, Didi has successfully extended its hands to Eastern Europe and Africa, investing in Taxify, a mobile transportation company focusing on Europe and Africa.

In 2018, Didi’s globalization began to grow more and more intense.

On February 9, 2018, Didi and SoftBank announced plans to form a joint venture to enter the Japanese taxi market. A month earlier, Didi also acquired Brazilian ride-hailing service 99, which had previously invested $100 million.

In fact, before 2018, Didi preferred to enter other overseas markets through equity investment, rather than directly expanding into the local market like Uber.

In response, Didi’s president, Jean Liu, has publicly said that the company will evaluate which new markets it should enter, possibly partnering with or competing with existing local ride-hailing companies. If Didi believes that local companies are not strong enough, it may compete with them. That is to say, Didi may not only enter overseas markets through various forms of grafting, but will also take a similar approach to Uber, directly entering the local market to provide taxi services.

But once you go overseas to open up territory, how to adapt to local policies and face competition with local competitors, these problems that have tested Uber need to be confronted by Didi one by one.

And the expansion of these international territories requires Didi to spend real money to open up the market.

Capital "change face"

The First Financial Reporter learned from Didi insiders that Cheng Wei emphasized at the conference that there will be long-term uncertainties in the future of capital, and that Didi will operate more finely in the future.

Didi, which merged quickly and acquired Uber’s China business, is the luckiest of the wave of mobile Internet travel startups.

And in this series of challenges, Didi’s ultimate move is to defeat its opponents many times through financing.

In terms of capital markets, Liu Qing was definitely a hero of Didi.

In 2002, Liu Qing joined the investment banking department of Goldman Sachs (Asia) Group in charge of "analyst work". In 2004, she moved to the direct investment department. In 2008, she was promoted to executive director. In 2012, after being promoted to managing director of Goldman Sachs (Asia) LLC Asia Pacific, Liu Qing became one of the youngest managing directors in the history of Goldman Sachs.

In September 2013 and June 2014, Liu Qing approached Didi Dache twice as an investor. The final result was that on July 28, 2014, Liu Qing was confirmed to join Didi Dache as the chief operating officer (COO). In February 2015, Liu Qing was promoted to the president of Didi.

With Liu Qing joining, news of Didi’s financing continues to spread.

In 2016, Didi Chuxing raised $7 billion in a funding round, gaining a number of powerful allies, including Apple, to fend off Uber’s competition in China at the time.

"Peace is made, not negotiated!" Zhu Xiaohu, an early investor in Didi, said that the chips for negotiating peace are getting higher and higher, and without these chips, there is no qualification to negotiate peace, so the team’s financing ability is extremely important.

In Cheng Wei’s opinion, Didi is building a mobile transportation ecosystem, which is something that no one has ever done before. It requires a large amount of capital to support the development of technology and various business lines.

"There will always be competition in various segments of personal mobility, but in the one-stop present on all major platforms, no one can do this except Didi. Not everyone has the confidence to shout’I want to do one-stop present on all major platforms’, and one of the confidence is capital. Without capital, it is difficult to shout out to be the world’s largest one-stop platform." Liu Qing explained in an interview with China Business News.

"Whether we will continue to raise money is still a question mark," Ms. Liu said during a critical period of competition with Uber. "We need to see if we can spend it or not, and the money is not bad. But we will recruit some investors, not for financing, but for strategic cooperation."

It is impressive that whether it is a special car, an express car, a hitchhiker or a bus, Didi is actually a latecomer to these markets. With the blessing of capital, Didi is more accustomed to opening the road with massive subsidies, squeezing out competitors, and then starting to work intensively.

The business behind this cannot escape the requirements of capital. The capital that keeps betting needs to tell one story after another in order to support the increasingly high valuation plate.

Now, the problem left to Cheng Wei and Liu Qing is that there will be long-term uncertainties in the future of capital, and Didi, which relies on capital to run wild, must now tighten its purse strings.

Didi’s old rivals Uber and Lyft are both actively planning to go public in the first quarter of this year, and Didi’s listing demand has become urgent.

But the current embarrassment is that due to the series of rectification storms triggered by the hitch safety incident, Didi has missed the listing boom of Xiaomi and Meituan last year.

Although Didi is currently actively planning to re-launch its ride-hailing business, the market is not optimistic about the future of Didi’s listing, which has lost its lead, despite the loss of two lives due to the loss of ride-hailing.

关于作者