Author | Wei YuqiEdit | Sunshine

In 1728, the French physician Fauchard punched holes in a long arched metal strip of a tooth and fixed the strip to the tooth with thread, thus achieving the purpose of straightening teeth. This is the beginning of global orthodontic treatment.

Since then, with the continuous research on orthodontics, related technologies have made great progress, but there are still shortcomings in the eyes of users.

Zia Chishti, a master’s student at Stanford, was an orthodontic patient. He wore the prevailing metal brackets of the time, which made him look a little unsightly and sore whenever his teeth were forced.

The poor experience of using metal brackets led Zia Chishti to discover transparent retainers, which can also help with tooth "shaping". From this, Zia Chishti thought of using invisible braces to solve the problems of metal brackets.

In 1996, Zia Christi teamed up with Chinese technical background Wen Huafeng to establish Avery Technology and designed the world’s first invisible braces "Invisalign Beauty". Today, Avery Technology has become the world’s leader, with a market value of nearly 50 billion US dollars.

From the discoverer Fauchard to the innovator Zia Christi, the experience of the predecessors has shown that there are many key points in this business. These include patient needs, technology, and as commercialization advances, channels have also become a key part. The newly listed Angel of the Times has copied the predecessor Avery Technology in the model, and the same is the key point that needs to be grasped.

However, there is a big gap between the achievements of Times Angel and Avery Technology. On the one hand, under the premise that the share gap is negligible, Times Angel does not have many obvious technical advantages; the leading position has not been exchanged for the ability to play well in the market; after the product structure is adjusted, the revenue growth rate has declined. On the other hand, it has not been able to avoid common problems in the industry such as dependence on dentists.

The "money printing machine" in the mouth

"Use technology to create a smile that affects the world" is the description in the value column on the official website of Times Angel. After the smooth listing, Times Angel has become the first "dental invisible correction stock" in China. Compared with patients who are still on the orthodontic road, investors in capital markets have tasted the beauty of "smile" first.

Angel was listed on the Hong Kong Stock Exchange on June 16. As of 10:16 on the same day, the share price rose to 473 Hong Kong dollars, an increase of 173%. According to the calculation of 200 shares per hand, one hand earned 60,000 Hong Kong dollars, surpassing the record of 55,440 Hong Kong dollars per hand earned by Beijing Holdings in 1997. It became a fully profitable new stock in Hong Kong, with a market value of more than 70 billion Hong Kong dollars.

Even if the market value fell on the 17th, compared with the issue price of 173 Hong Kong dollars and the valuation of 25 billion Hong Kong dollars, the trend of Times Angel is still rising. It can be seen that the capital markets are very optimistic about it.

Before going public, Times Angels spent 880,000 yuan and commissioned a market research report from Caution Consulting. The content of this report explains why capital markets are optimistic about Times Angels.The reason is actually very simple. The orthodontic industry has great potential, and Angel of Times leads the market share and enjoys the leading dividend.

In fact, long before the IPO door was opened, capital had already taken notice of the angels of the era.

In 2015, when Time Angel turned a profit, it became a star company. Feng Dai, who spent 11 years as a healthcare investor at Warburg Pincus, founded Songbai Investment with the support of Hillhouse Capital. The first case was to invest in Time Angel. According to the prospectus, Songbai Investment is currently the largest shareholder of the latter.

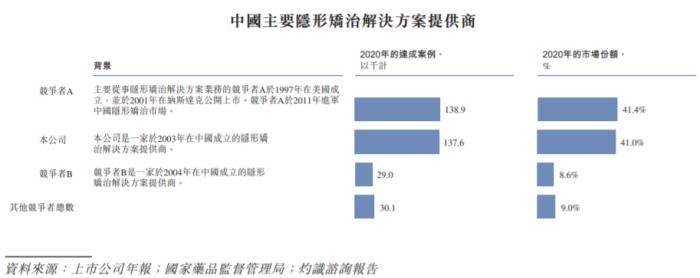

In the first three quarters of 2020, Time Angel has become the leading player in the domestic market.

In terms of achieved cases, Time Angel held 41.3% of the domestic market share in the first three quarters of 2020, followed by Invisalign with a combined 82.3% market share.

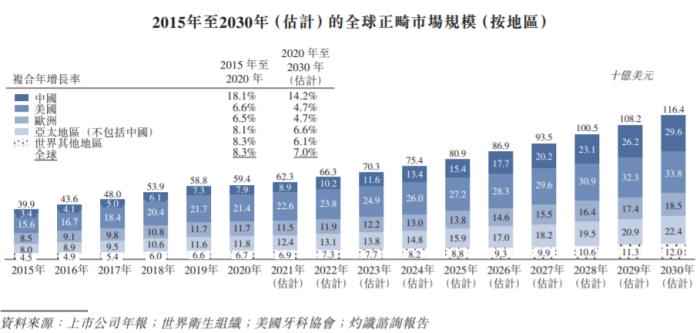

In 2015, there were only 47,800 cases of invisible orthodontics in China. By 2019, the number of cases had skyrocketed to 304,000, with a compound annual growth rate of 58.8%. It is expected to reach 3.80 million cases in 2030, with a compound annual growth rate of 25.9%.

In 2019, the size of China’s invisible orthodontic market was second only to the United States and ranked second in the world. In terms of retail sales revenue, the market size increased from $200 million in 2015 to $1.40 billion in 2019, with a compound annual growth rate of 56.0%. It will reach $11.90 billion in 2030.

Specifically, the industry’s penetration rate in 2020 is only 11.0%, far lower than the US market. Time Angel’s gross profit margin in the same period was 70.4%, 63.8% in 2018 and 64.6% in 2019. The adjusted net profit in the first nine months of 2020 exceeded 200 million yuan, nearly double that of the same period last year.

The market has great potential and the industry has high gross profits. The combination of these factors makes it impossible for the market not to treat the angels of the times differently. However, the enthusiasm of capital for the angels of the times is not entirely out of love for it.

Obviously, the entire medical beauty market, including orthodontics, has been a hot topic recently. Huaxi Bio, the leader of hyaluronic acid, and Tongce Medical, which also does oral business, have a market value of more than 100 billion. And the reason why they are optimistic is the same as the angels of the times.

Take Huaxi Bio as an example. The global hyaluronic acid market reached $74.50 billion in 2019, growing at a rate of 3.2%. Due to the wide popularity and acceptance of "hyaluronic acid" in the cosmetics field, the scale of China’s hyaluronic acid market has grown rapidly, and the growth rate is higher than the global level. The huge population base and plastic surgery demand make China expected to become the world’s largest hyaluronic acid consumer market.

In 2020, Huaxi Bio acquired Dongchen Bio, the fourth in the industry, and gained 8% market share from the latter. So far, Huaxi Bio has occupied half of the hyaluronic acid raw material market.

In terms of penetration rate, compared with the level of 1% to 2% in developed countries, the penetration rate of the Chinese market is only 0.18%, which is far lower than that of developed countries.

Huaxi Bio’s Mao Libby era angel is even higher. From 2016 to 2018, the gross profit margin of Huaxi Bio’s main business was 77.22%, 75.40% and 79.94% respectively, and the comprehensive gross profit margin has remained close to 80%. The gross profit margin of some products even exceeded 90%, comparable to Moutai. In 2020, the gross profit margin of the main business rose to 81.89%.

From Huaxi Bio and Time Angel, two leaders in different segments of the medical beauty industry, it is not difficult to see that the medical beauty industry is simply tailor-made for "track theory". Don Valentine, founder of Sequoia Capital, believes that it is better to invest in a company with a huge market demand than to invest in a company that needs to create market demand.

In other words, for the medical beauty star stocks in the capital markets, the capital is actually optimistic about the medical beauty industry, and the first place is Huaxi Bio or Angel of the Times.

The spots under the angel’s wings

The original Invisalign was unpopular because it was not effective and expensive. Zia Christi invested heavily in marketing, and in 2000 alone, TV advertising reached $31 million. The New York Times called it the more aggressive consumer advertising program the dental industry has ever seen.

However, this more aggressive advertising plan still failed to open up the market for Invisalign, and Avery Technology lost money for several years. It was not until Joseph M. Hogan, Zia Christi’s successor, adjusted his strategy and turned the marketing target from C-end patients to dentists. By sharing the benefits with doctors, Avery Technology opened up the market and thus got out of trouble.

From the experience of previous generations, marketing and dentists are as important to Angel of the Times as traffic is to e-commerce platforms. And this is where Angel of the Times falls short.

On the quota between marketing and R & D, the Angel of the Times embarked on the route of emphasizing marketing and neglecting R & D.

The performance of light R & D has two points. It is more intuitive that the R & D expenses of Times Angel are lower than the marketing expenses. The R & D expenses of Times Angel in 2018, 2019 and the first nine months of 2020 were 50.20 million yuan, 80.90 million yuan and 58.90 million yuan respectively, accounting for 10.3%, 12.5% and 11.4% of the revenue in the same period. The sales and marketing expenses during the period were 81 million yuan, 123 million yuan and 149 million yuan respectively, accounting for 16.7%, 19.0% and 18.2% of the total revenue respectively.Whether it is the scale of investment or the proportion of revenue, marketing expenses are higher than research and development expenses.

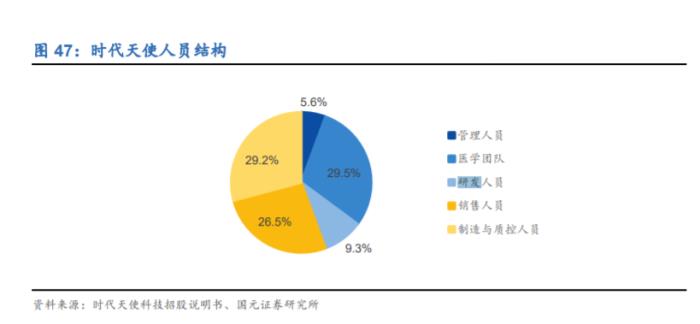

The same is true in terms of employee composition. As of September 30, 2020, Angel’s R & D team had 120 employees, accounting for 9.3% of the total number of employees, while sales personnel accounted for nearly 30%.

More importantly, the competition between Angel of the Times and Invisalign was very intense.The former’s market share in the first nine months of 2020 was 0.3 percentage points ahead of the latter, and after only three months, the latter achieved a narrow advantage of 0.4 percentage points. The market position advantage of the Times Angels is almost negligible, and the two are on the same starting line.

In terms of sales model, Times Angel has also adopted the model of dentists playing a leading role. However, domestic general dentists and orthodontists have the characteristics of large demand and unmet, which directly affects the long-term development of Times Angel.

According to the report, there were about 158,400 general dentists and 10,800 orthodontists in the United States in 2020, equivalent to 47.8 general dentists and 3.3 orthodontists per 10,000 people. In comparison, China had about 277,500 general dentists and 6,100 orthodontists during the same period, equivalent to 19.5 general dentists and 0.4 orthodontists per 100,000 people, far less than in the United States.

More importantly, a dentist who meets national requirements and meets technical standards has a long training period, ranging from five years to ten years. This exacerbates the shortage of dentists.

Also having a detrimental impact on development is the adjustment of Angel’s product structure.

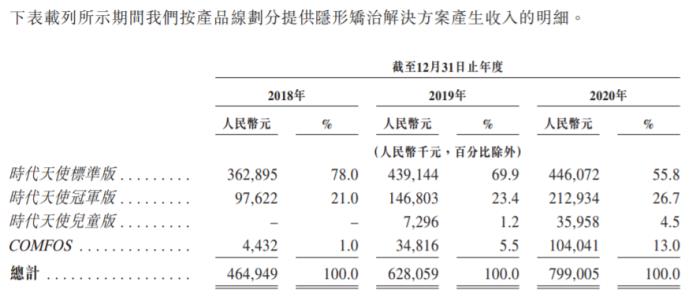

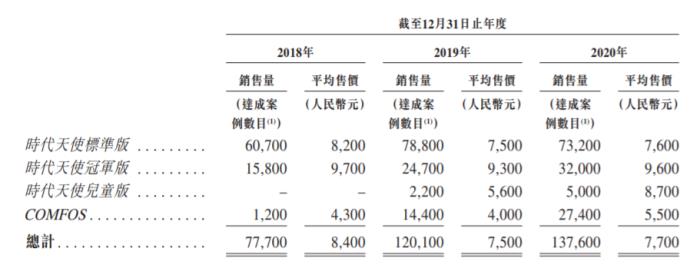

At present, Angel of Times owns a total of four products, ranked by the average price from high to low as Champion Edition, Children’s Edition, Standard Edition, and COMFOS. From 2018 to 2020, the share of COMFOS with the lowest average price increased the most, from 1% to 13%. The champion version with the highest average price only increased by 5 percentage points, and the standard version with the largest proportion declined the most, reaching 23 percentage points.

At the same time, the sales of the Champion Edition increased from 15,800 in 2018 to 32,000 in 2020, and the growth rate slowed from 56% in 2019 to 29.5% in 2020. COMFOS sales increased from 1,200 in 2018 to 27,400 in 2020, and the growth rate fell from 1100% in 2019 to 90% in 2020.

The growth rate of revenue in the same period also fell from 32.38% in 2019 to 26.47% in 2020. Although the epidemic has had an adverse impact on revenue, the changes in the proportion of Champion Edition, Standard Edition and COMFOS still reveal a fact. That is, in the process of adjusting the product proportion structure, Angel of Times did not control the decline of Standard Edition, nor did it allow COMFOS sales to make up for the vacancy caused by the structural adjustment in time. This shows that,Although Angel of Times is a market leader, it is still unable to navigate market changes with ease.

In terms of revenue and profit performance, the leading position of Times Angel is even more unstable. Tongce Medical’s revenue in the first quarter of this year was as high as 631 million yuan, which was only 200 million away from Times Angel’s revenue in 2020, with a year-on-year growth rate of 221.59%. Net profit in the first quarter was 164 million yuan, close to the level of Times Angel in 2020. Invisalign’s parent company, Avery Technology, is even larger, with revenue of 2.472 billion US dollars and net profit of 1.776 billion US dollars in 2020.

Even so, the dynamic price-to-earnings ratio of the Angel of Times is still as high as 343 times, while Avery Technology is only 103 times. The Angel of Times, which has little market and R & D advantages, is overestimated to a certain extent.

conclusion

In 2019, Invisalign’s parent company, Avery Technology, and Covestro, a manufacturer of polymer materials solutions, released transparent correction products made of SmartTrack ? materials. This is the same move as Angel of the Times in research and development. In 2017, it announced the application of MasterControl, a new medical polymer material, to the whole line of products.

Through the comparison of these two materials, it is possible to see to a certain extent what the level of competitiveness of Angel of Times is on a global scale. According to multiple public information and research reports of securities companies, these two materials are on par in terms of comfort, elasticity, tear resistance and other major dimensions.

This once again clearly reflected the current situation of the Angel of the Age, that is, when the advantages are not obvious, the treatment is extraordinary. Since 2003, the Angel of the Age, who has gone through 18 years, has perfectly stepped on the pace of the times and has become the "angel" of tens of thousands of patients. However, the Angel of the Age itself has not found the "angel" who can help it out of the predicament.

Under the external worries and internal troubles, the leading position of the Angel of Times is not stable. Once the aura of leading position is lost, the capital that values the prospects of the industry will undoubtedly be the first to vote with their feet.

关于作者